Five9's Business Model and Market Position

Five9's core value proposition rests on its cloud-based contact center software (CCaaS). This platform provides a comprehensive suite of tools for managing customer interactions, including employee management, advanced analytics, and predictive call routing. This comprehensive offering caters to a diverse range of industries, mitigating risk associated with over-reliance on any single sector. However, the CCaaS market is highly competitive, with both established players and disruptive startups vying for market share. This competitive landscape presents both opportunities and significant challenges to sustained growth and profitability.

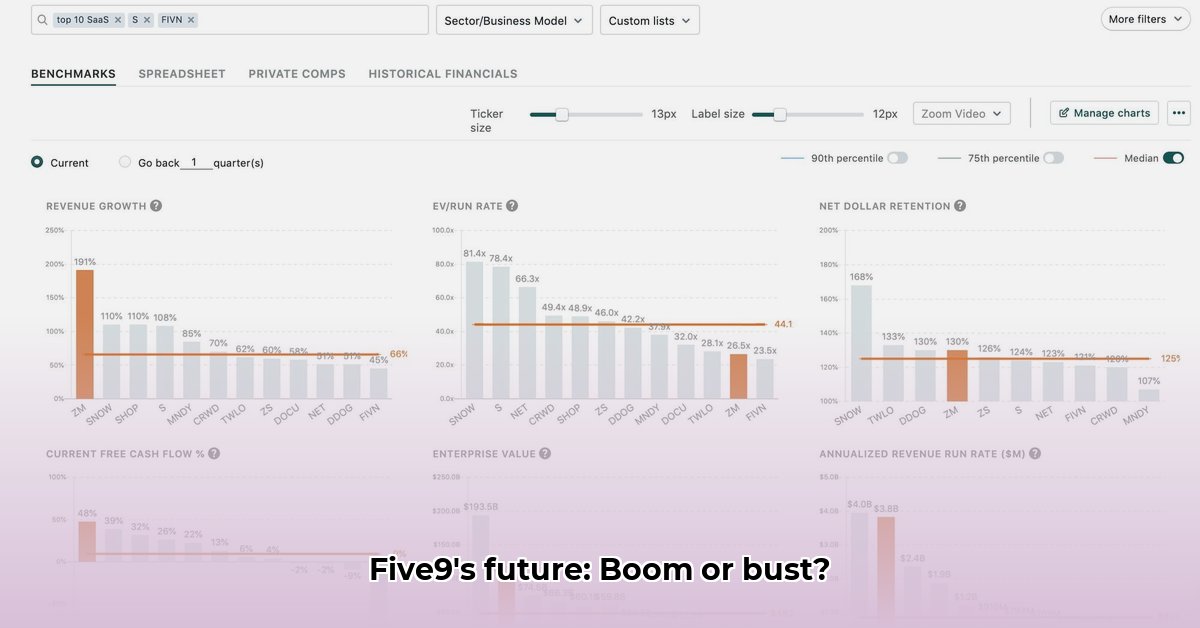

Financial Performance and Valuation Volatility

Reports indicate significant fluctuations in Five9's valuation, ranging from a reported $351.8 million in 2014 to over $3 billion in 2025. A reported year-over-year decline of 45.69% at a certain point underscores the volatility inherent in the company’s market capitalization. This underscores the need for a nuanced understanding of its financial performance and the underlying factors driving these dramatic swings. Unfortunately, readily available, granular financial data such as detailed profit margins and customer churn rates remains surprisingly scarce, hindering a comprehensive assessment. This lack of transparency poses a significant challenge to accurate valuation.

Key Risks and Mitigation Strategies

Five9 faces several key risk factors that can significantly impact its net worth:

| Risk Factor | Likelihood | Impact | Mitigation Strategies |

|---|---|---|---|

| Intense Competition | High | High | Continuous innovation, strategic partnerships, targeted marketing. |

| Economic Slowdowns | Medium | High | Diversified customer base, operational efficiency improvements. |

| Technological Changes | Medium | Medium | Robust R&D, agile adaptation to emerging technologies. |

| Regulatory Compliance | Low | Medium | Proactive compliance with GDPR, CCPA, and other relevant regulations. |

Future Outlook and Investment Considerations

Five9's future prospects depend on its ability to maintain a competitive edge and navigate economic uncertainty. Sustained innovation, strategic partnerships, and a focus on customer retention are crucial for long-term growth. However, the inherent volatility in its valuation necessitates a cautious approach for potential investors. A diversified investment portfolio and a long-term perspective are recommended for mitigating risk. The lack of readily available detailed financial information necessitates thorough due diligence before making any investment decisions.

Key Takeaways:

- Five9's revenue growth is substantial, but profitability remains a critical concern, contributing to market valuation volatility.

- Analyst opinions on Five9’s valuation diverge significantly, reflecting market uncertainty.

- A deep understanding of the competitive CCaaS market landscape is essential for a comprehensive evaluation.

Addressing Information Gaps: The Need for Transparency

The significant discrepancies in available financial data highlight a crucial need. Five9 and similar companies should prioritize enhanced financial transparency to foster investor confidence and reduce market fluctuations. Providing more granular data will help analysts and investors perform more rigorous due diligence and develop more reliable valuation models.

A Call for Enhanced Financial Reporting

The current information scarcity prevents a definitive conclusion regarding Five9's long-term trajectory. Substantially more detailed financial reports, coupled with transparent communication from management, are essential for a complete and balanced assessment of the company's intrinsic value and future prospects. This enhanced transparency is not just beneficial for investors; it is critical for maintaining the trust and confidence of stakeholders across the board.